kentucky vehicle tax calculator

Your average tax rate is 1198 and your marginal. Every year Kentucky taxpayers pay the price for driving a car in Kentucky.

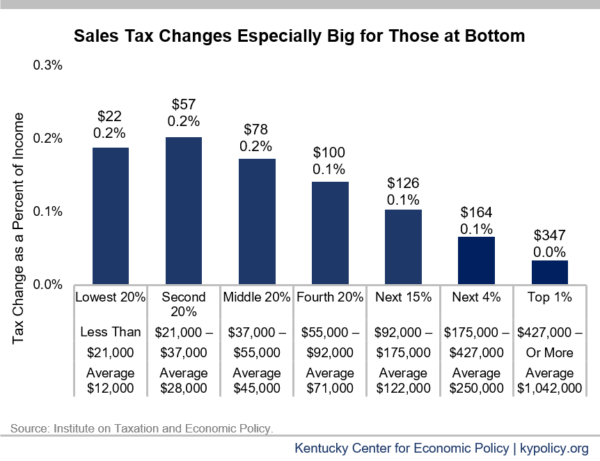

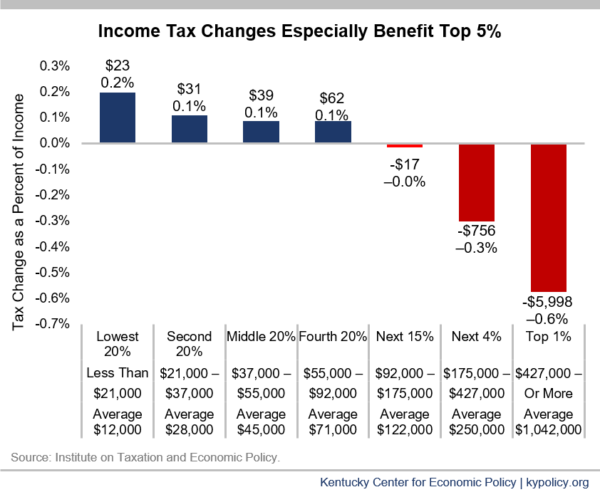

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

. Beer in Kentucky is taxed at a rate of 8 cents per gallon while wine has a tax rate of 50 cents per gallon. Our free online Kentucky sales tax calculator calculates exact sales tax by state county city or ZIP code. DEC 20 2020.

Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. It is levied at six percent and shall be paid on every motor vehicle. Vehicle value includes options which customers vehicle does not contain.

The Service Members Civil Relief Act exempts certain military personnel from paying personal vehicle Ad Valorem tax. Assessment Value Homestead Tax Exemption. Dealership employees are more in tune to tax rates than most government officials.

Will also add 12 interest compounded monthly to unpaid taxes. In 2018 Kentucky legislators raised the cigarette. Two unique aspects of kentucky vehicle property tax calculator state rate 6 of 5 taxable tax-exempt.

Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all. Property taxes in Kentucky follow a one-year. Kentucky Property Tax Rules.

Please note that special sales tax. Inquiries on refund status can be sent to motorvehiclerefundkygov or by calling 502-564-8180. Vehicle has been wrecked and damage has not been repaired prior to assessment date January 1.

Check this box if this is vacant land. Vehicle has a. If you are unsure call any local car dealership and ask for the tax rate.

Kentucky has a 6 statewide sales tax rate but also. Kentucky Documentation Fees. Property Valuation Administrators PVAs in each.

A motor vehicle usage tax of six percent 6 is levied upon the retail price of vehicles registered for the first time in Kentucky. Overview of Kentucky Taxes. Kentucky does not charge any additional local or use tax.

How to Calculate Kentucky Sales Tax on a Car. Two unique aspects of kentucky vehicle property tax calculator state rate 6 of 5 taxable tax-exempt. In the case of new vehicles the retail price is the total.

Depending on where you live you pay a percentage of the cars assessed value a price set by. Please note that this is an estimated amount. Motor Vehicle Usage Tax.

Average DMV fees in Kentucky on a new-car purchase add up to 21 1 which includes the title registration and plate fees shown above. If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753. The state of Kentucky has a flat sales tax of 6 on car sales.

Actual amounts are subject. Kentucky Income Tax Calculator 2021. To find out if you qualify for the exemption please get in.

Once you have the tax. Kentucky car tax is 240150 at 600 based on an amount of 40025 combined from the sale price of 39750 plus the doc fee of 475 plus the extended warranty. In the case of new vehicles the retail price is the total.

This publication reports the 2020 2019 ad valorem property tax rates of the local governmental units in Kentucky including county city school and special district levies. Kentucky Property Tax Calculator.

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

How To Lower Your Annual Motor Vehicle Tax Bill In Louisville

Car Rental Taxes Reforming Rental Car Excise Taxes

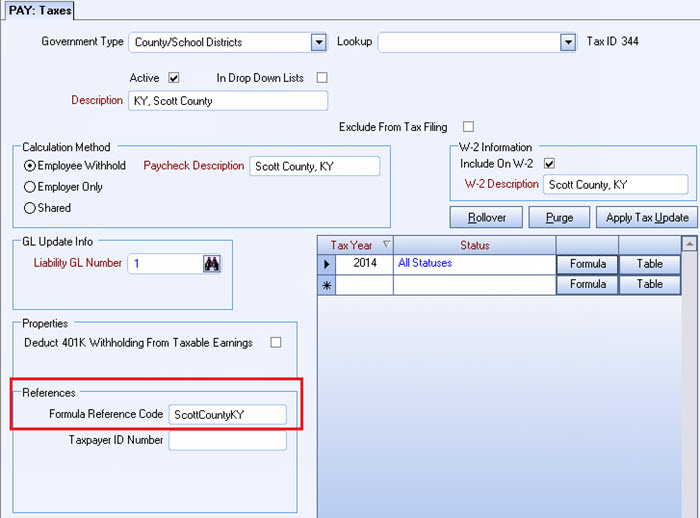

Kentucky County School District Taxes

2019 2020 County Insurance Premium Tax Rates

Ohio Sales Tax Small Business Guide Truic

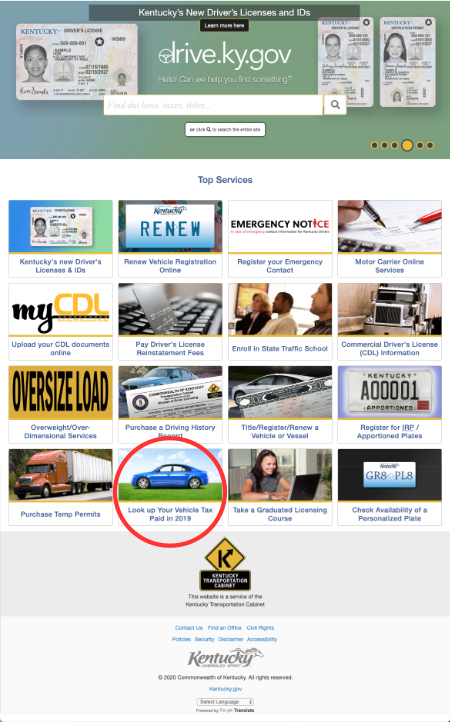

2020 Vehicle Tax Information Jefferson County Clerk Bobbie Holsclaw

Sales Tax On Cars And Vehicles In Kentucky

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

New Jersey Sales Tax Calculator And Local Rates 2021 Wise

Property Tax Rate Will Stay The Same City Of Covington Ky

States Moving Away From Taxes On Tangible Personal Property Tax Foundation

Car Tax By State Usa Manual Car Sales Tax Calculator

States With The Highest Lowest Tax Rates

Why Are Kentucky Car Tags So High This Year Lexington Herald Leader